How Going Against the Grain in My 20s Changed Everything

Financial lessons from the decisions we made in our 20s to transform our future

I'm sitting at my desk on this quiet Saturday afternoon, I look back and can see those pivotal moments as clear as day – those crossroads where we chose one path over another, each choice shaping our present reality. It's fascinating how life works, isn't it? One investment decision, one career move, one bold step forward – these seemingly small choices have transformed our financial landscape in ways we never imagined.

I want to share our story with you. This will probably have to be broken into multiple parts. Think of this as your backstage pass to our financial journey – the victories, the close calls, and yes, even the mistakes that taught us the most valuable lessons. Because here's the thing: your financial story is still being written, and every insight I share could be the key that unlocks your next big breakthrough. Here we go.

Before we dive into the topic of the day, I’ll share a cool and random economic fact of the week. Let’s call these RBI’s (Random But Interesting). These facts will give us useful info, often with a picture or chart to make it clearer. The aim is to help us make smarter financial choices

Random But Interesting (RBI)

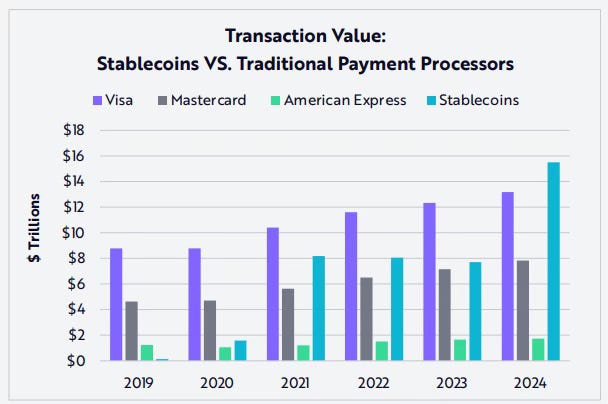

Global stablecoin adoption has surged dramatically, with market capitalization now exceeding $225 billion. The utility of these digital assets is evident in their transaction volume, processing nearly $16 trillion in 2024 - surpassing traditional payment giants like Mastercard and Visa. Major economies including Japan, Singapore, and the UAE have embraced this trend by establishing clear regulatory frameworks, while traditional banks leverage stablecoins for efficient cross-border settlements, benefiting from 24/7 operation and lower costs compared to SWIFT. This mainstream acceptance is further demonstrated by Stripe's integration of Stablecoin payments, while developing economies increasingly use them as a hedge against local currency volatility. For more about Stablecoins, check out the link below

The Finance Hub is a reader-supported publication. To gain access to premium content and live webinar replays, consider becoming a paid subscriber

Now, back to our regular scheduled topic:

Picture this: My graduation day, diploma in hand, electrical engineering degree complete. I knew everything about circuits and programming, but nothing about managing money or building wealth. I was lucky to get a job right out of school, but illiterate about what to do with the money I earned. Like many of you might be feeling right now, I was at the start of adult life completely unprepared for its required financial responsibility. No one had taught me about budgeting, investing, or buying a home. That's when it hit me – NO ONE IS COMING TO SAVE YOU. If I wanted to succeed, I had to take control of my own financial education.

Lesson #1

You are in charge on your destiny and have the power to change course any time you want. You just have to make the decision

It's tempting to point fingers at the economy, our background, or that investment tip that didn't pan out. I get it. Think about it like this: your current financial situation is like a point on a map. It shows exactly where you are, based on every turn you've taken so far. Scary? Maybe. But here's the exciting part – you've got the power to punch in a new destination anytime you want. Whether that's building an emergency fund, starting a side hustle, or making your first investment, you're in the driver's seat.

Back to the story. My wife, Tolani, and I started dating in college, and from the time we knew we were serious about each other, we developed the skill of dreaming bigger than our bank accounts could imagine at the time. We didn’t just want to make wishful small talk – we wanted to be architects of our future, drawing up detailed blueprints of the life we yearned to build together.

"Let's live in that neighborhood with the tree-lined streets," Tolani would say, and I'd add, "With a home office and a large backyard where our kids will play." We'd spend hours like this, mapping out every detail: the modern kitchen where we'd host family gatherings, the exact model of car we'd park in the driveway, even the schools our future children would attend. Some might have called us naive, but we called it vision.

But here's where dreaming met reality: these weren't just daydreams to help us escape our instant ramen budget. Each shared vision became a puzzle we were determined to solve. I dove into financial education like never before, devouring books on investing and wealth-building. My Amazon cart became filled with titles like "Rich Dad Poor Dad" and "The Millionaire Next Door." Every page turned was another piece of our puzzle falling into place.

Let me tell you – when you're reading “Tax Free Wealth” while your friends are talking about the latest episode of “Scandal”, you might feel like an outsider. But that's the price of pursuing an extraordinary life. Each book became a stepping stone on our path from dreamers to doers.

Lesson #2

Knowledge is the key to unlock anything we want from life. Pure and simple. Not luck. Not privilege. Not even money – at least not to start.

"But what about those born with silver spoons?" I hear you say. For every "privileged success story" you hear about, there's someone who started with less than you and me who made it even bigger. Think of Oprah Winfrey, who grew up in rural poverty before becoming a media mogul. Or Tyler Perry, who grew up in a very difficult situation in Louisiana before building his empire.

To take a step back our the story, from our time in college, Tolani and I knew that we wanted to build a life together. Even though we were relatively young at the time, we never felt surer of our decision to be together. One month after trading my graduation cap for an entry-level engineer's badge, I was down on one knee, holding a ring that cost more than my bank account wanted to admit. Some of our friends thought we were rushing, our relatives raised their eyebrows (granted our African parents were excited haha), and everyone had an opinion about us being "too young." The questions came like a flood: "Why not wait?" "Don't you want to experience life first?" "What's the rush?"

But here's what they didn't understand: when you find the right co-pilot for life's greatest adventure, waiting is just wasting time. While others saw two naive college graduates, we saw two architects ready to build our empire together. The way I figured it, if I already knew Tolani was the person I wanted to share my morning coffee with at 50, why not start at 24? Life's biggest rewards often come from daring to break the "standard" timeline.

Lesson #3

Here’s a truth that could make or break your financial future: choosing your life partner is also choosing your financial destiny.

Imagine how both of these stories play out. One friend's spouse encouraged him to start his business, even picking up extra shifts to support their dream. Another's partner racked up secret credit card debt that took years to untangle. Both married, drastically different outcomes.

With Tolani, our partnership has had a multiplier effect. When I hesitate to invest in a promising opportunity, she's there with the words of encouragement, telling me to just make the first step. When she was considering a career move that took her away from her 9-5 job, I was there for support. In our case, one plus one doesn't equal two – it equals ten.

If you are interested in learning more about this topic, check out this previous post:

Think about that famous saying: you're the average of your five closest friends. If you're hanging out with five people who are not ambitious or have a drive to succeed, guess what starts to feel normal to you? If your inner circle sees investing as "gambling," how likely are you to start your wealth building journey?

But here's the beautiful plot twist – in today's digital age, your "five closest friends" don't all have to live in your zip code. In an effort to build a community of people that shared similar dreams, I started searching for a whole new crew online, while still maintaining my existing friend group. This could be as simple as finding:

The podcast host who breaks down complex investment strategies over your morning commute

The YouTube creator who teaches you to read financial statements like they're comic books

The Finance Hub community where we share economic lessons and personal stories of success…shameless plug 😉

In the Finance Hub, we're not just about sharing tips – we want to share dreams, strategies, and victories, celebrating each other along the way.

As we wrap up today's chapter of our financial journey, picture yourself a year from now. Will you be telling the story of how this was the moment everything changed? How you stopped letting life happen to you and started happening to life?

I have a challenge for you: take one step toward your financial dreams this week. Open that investment account. Have that money conversation with your partner. Join our Finance Hub community. Small hinges swing big doors.

Drop a comment below about which part of today's story resonated most with you, or share your own financial turning point. Your story might be exactly what someone else needs to hear.

The story continues in part 2…

Why Many Still Struggle in this "Strong" Economy

Hey everyone! It’s a new month and I hope we have a productive rest of the year. In recent times, the economic conversation has been dominated by a puzzling paradox: many people feel as though we are in a recession, yet some key economic indicators suggest otherwise. This dichotomy has left economists, policymakers, and everyday citizens scratching thei…

Great read. Tax Free Wealth is a game changer!

👏🏾👏🏾👏🏾 lovely article Finance Hub! Very valid points were made. Indeed, going against the grain makes one look delusional in the beginning but eventually pays off when you start to see the fruits of your labor. And yes, community is key 🔑 because no one is an island