How Much Do You Really Need to Retire Comfortably?

Setting Clear Goals for your Financial Future

ANNOUCEMENT:

Saturday, November 23rd @ 11AM CST, Tolani and I are hosting “Family Financial Fitness: Building your Financial Future Together”. We’ll discuss:

Having clear discussions about money

Setting Financial goals together

Raising kids to be financially literate

Dealing with “Black Tax” and setting the right boundaries

This event is FREE to attend. Click HERE to RSVP for the event and add to your calendar

In today's fast-paced world, it's easy to get caught up in the day-to-day and lose sight of our long-term financial goals. However, one of the most crucial aspects of financial planning is preparing for retirement. Many people underestimate how much they'll need to save, leading to financial stress later in life. This post will guide you through the process of accurately determining your retirement needs and highlight why having a specific goal is essential for effective planning.

Before we dive into the topic of the day, I’ll share a cool and random economic fact of the week. Let’s call these RBI’s (Random But Interesting). These facts will give us useful info, often with a picture or chart to make it clearer. The aim is to help us make smarter financial choices

Random But Interesting (RBI)

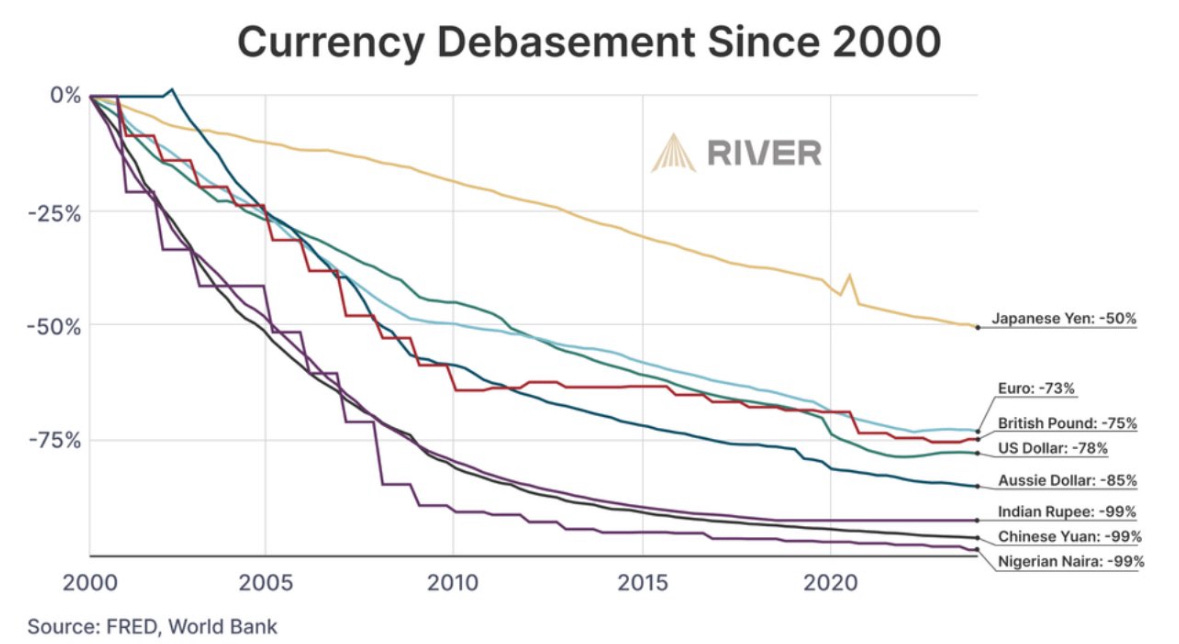

Central bank policies, particularly in recent decades, have often prioritized economic stimulus and financial stability through expansionary monetary measures. These policies, including quantitative easing (creating new money) and maintaining low interest rates, have led to significant increases in money supply. While intended to boost economic growth and combat deflationary pressures, these actions have contributed to currency debasement – a reduction in the purchasing power of money. For individuals, this manifests as a subtle but persistent erosion of their savings and income. As the value of currency declines, the cost of goods and services rises, outpacing wage growth for many. This "invisible tax" disproportionately affects those on fixed incomes or with substantial cash savings, as their buying power diminishes over time. Additionally, it can distort investment decisions, pushing individuals towards riskier assets in search of returns that outpace inflation. The long-term consequences of this debasement include increased wealth inequality, as those with assets that appreciate in inflationary environments (like real estate, stocks, or Bitcoin) tend to benefit, while those relying primarily on cash savings or fixed incomes struggle to maintain their standard of living.

The Finance Hub is a reader-supported publication. To gain access to premium content and live webinar replays, consider becoming a paid subscriber

Now, back to our regular scheduled topic:

Understanding why retirement planning matters is essential for your future financial well-being. In today's world, retirement planning has become increasingly important for several key reasons. First, advances in healthcare mean people are living longer than ever before, so retirement savings need to last much longer - potentially 20 to 40 years after leaving the workforce. Additionally, the modern economy has shifted away from traditional pension plans, leaving individuals responsible for building their own retirement funds. Another crucial factor to consider is the rising cost of healthcare, which typically increases as we age and can use up a substantial amount of our savings. Most people naturally want to maintain their current lifestyle during retirement, which requires careful financial preparation well in advance. Finally, having a solid retirement strategy helps reduce stress about the future, allowing retirees to truly enjoy their golden years without constant financial worry. All these factors highlight why starting to think about retirement planning, even as a young person, is a smart financial decision.

When figuring out how much money you'll need for retirement, the first crucial step is estimating your future annual expenses. This calculation starts with basic living costs like housing, which includes either mortgage payments or rent, along with property taxes and home maintenance. You'll also need to account for regular monthly bills such as utilities, food, and groceries. Healthcare costs and insurance premiums are particularly important to consider, as these often increase as you age. Transportation expenses, whether it's maintaining a car or using public transit, should also be included in your calculations. Many retirees want to enjoy their free time through travel and leisure activities, so setting aside money for these pursuits is important too. It's also wise to consider potential long-term care needs that might arise in later years. One key factor that's often overlooked is inflation - the gradual increase in prices over time that can reduce your money's buying power. By carefully considering all these expenses now, you can better prepare for a comfortable retirement in the future.

The second step in retirement planning involves identifying and calculating all potential sources of income you expect to receive during your retirement years. A primary source for most Americans is Social Security benefits, which provides a regular monthly payment based on your work history and contributions. If you’re fortunate enough to have a pension plan through your employer, you should include these expected payments in your calculations as well. Some retirees also generate income through rental properties or other passive income streams, such as investments or business ownership. Additionally, you might want to consider whether you plan to work part-time during retirement, as many retirees choose to maintain some form of employment to supplement their income or stay active in their community. By adding up all these potential income sources, you can better understand how much additional savings you'll need to achieve your desired retirement lifestyle.

Now that we have determined our living expenses and all potential sources of income, subtract your expected income from your estimated expenses. This difference is the amount you'll need to cover from your retirement savings each year.

A helpful guideline in retirement planning is the widely-used ‘4% rule’, which provides a straightforward way to estimate how much money you'll need to save. This rule suggests that you can safely withdraw 4% of your total retirement savings during your first year of retirement, and then adjust that amount each year to account for inflation. This approach is designed to help your savings last for about 30 years. To calculate your target savings goal using this rule, you'll need to multiply your expected annual retirement expenses (after subtracting expected income from sources like Social Security) by 25. For instance, if you determine you'll need $40,000 per year from your savings to cover your expenses, you would multiply this by 25, resulting in a target retirement savings of $1 million. While this rule provides a useful starting point for planning, it's important to remember that it's a general guideline and might need to be adjusted based on your specific circumstances, such as your expected retirement length, investment strategy, and risk tolerance.

While the 4% rule provides a good foundation for retirement planning, it's essential to customize your savings strategy based on your unique situation and goals. If you're planning to retire earlier than the traditional age, you might need to consider using a lower withdrawal rate, such as 3-3.5%, to ensure your savings last throughout your extended retirement period. Your personal comfort level with investment risk also plays a crucial role, as a more conservative investment approach might require a lower withdrawal rate to maintain financial security. Health considerations and family history should also influence your planning - if your family tends to live longer or if you anticipate higher healthcare costs, you'll want to increase your savings target accordingly. Additionally, your desired retirement lifestyle significantly impacts how much you'll need to save. For example, if you dream of extensive travel or have expensive hobbies you want to pursue during retirement, you'll need to factor these additional costs into your calculations. By carefully considering these personal factors, you can develop a more accurate and personalized retirement savings goal that better reflects your individual needs and aspirations.

Leave a comment if you were surprised by how much you needed for retirement after you calculated your expenses

The Importance of a Specific Retirement Goal

Now that we've outlined how to calculate your retirement needs, let's explore why having a specific goal is crucial:

1. Motivation and Focus

Having a concrete number to work towards can be incredibly motivating. It transforms retirement saving from a vague concept into a tangible goal, making it easier to stay focused and committed to your savings plan.

2. Informed Decision Making

With a specific goal in mind, you can make more informed decisions about your current spending and saving habits. You'll be better equipped to evaluate whether certain expenses are worth sacrificing your long-term financial security.

3. Effective Strategy Development

Knowing exactly how much you need allows you to develop a more effective savings and investment strategy. You can determine how much you need to save each month and what rate of return you'll need to achieve your goal.

4. Progress Tracking

A specific goal enables you to track your progress more accurately. You can regularly assess whether you're on track and make adjustments as needed, rather than realizing too late that you're falling short.

5. Reduced Anxiety

Understanding your needs and having a plan to meet them can significantly reduce financial anxiety. Instead of worrying about an uncertain future, you can feel confident that you're taking concrete steps towards a secure retirement.

6. Flexibility for Life Changes

Life is unpredictable, and your retirement needs may change over time. Having a specific goal allows you to more easily adjust your plan as circumstances evolve, whether due to career changes, family situations, or shifting priorities.

Putting It All Together: Your Action Plan

Now that you understand the importance of calculating your retirement needs and setting a specific goal, here's how to put this knowledge into action:

1. Conduct a thorough analysis of your current financial situation.

2. Use the steps outlined above to estimate your retirement needs.

3. Set a specific savings goal based on your calculations.

4. Develop a detailed savings and investment plan to reach your goal.

5. Regularly review and adjust your plan as needed.

6. Consider consulting with a financial advisor to refine your strategy and ensure you're on the right track.

Remember, retirement planning is not a one-time event. It's an ongoing process that requires regular attention and adjustment. By taking the time to accurately determine your needs and set specific goals, you're taking a crucial step towards ensuring a comfortable and secure retirement.

The journey to a well-funded retirement may seem daunting, but with careful planning and consistent effort, it's entirely achievable. Start today, and future you will thank you for your foresight and dedication to securing a comfortable financial future.

Great read! Love using the listening feature to go through these during my work day, it’s like listening to my audiobooks 😁.

Very interesting article - with robust considerations! Retirement is a road that may look far away, but you could shock yourself by how quickly you cover the distance! No one should allow themselves be caught unprepared. A company I used to work for did a study because they saw many retirees dying within 10 years of retirement (less than 70 years)! Reason discovered - poor planning for retirement, resulting in sharply lower standard of living than when they worked, which led to depression, and all the ailments associated with depression. Surprised? I determined I wouldn’t allow that happen to me.

The issue that now needs be considered is how to manage the menace of inflation, political and economic instability on such long term savings! It’s concerning that the way so many things seem tied to the economy, one’s best effort at saving may not lead to anticipated eureka. We need to discuss means to mitigate against these “thiefing” issues.