Your Money is Guaranteed to lose value over Time

How our current Financial system is guaranteed towards currency debasement

Today’s economy is complex, shaped by decades of globalization, technological advancements, and policy decisions. As we face rising prices, income inequality, and increasing government debt, it’s important to understand the historical forces behind these trends and what they mean for the future. With a clearer understanding of these dynamics, we can better position ourselves to navigate the challenges ahead and even benefit from them. Let’s take a deeper look into how outsourcing, government debt, and currency debasement have created our current economic situation and why prices are likely to continue rising.

Before we dive into the topic of the day, I’ll share a cool and random economic fact of the week. Let’s call these RBI’s (Random But Interesting). These facts will give us useful info, often with a picture or chart to make it clearer. The aim is to help us make smarter financial choices

Random But Interesting (RBI)

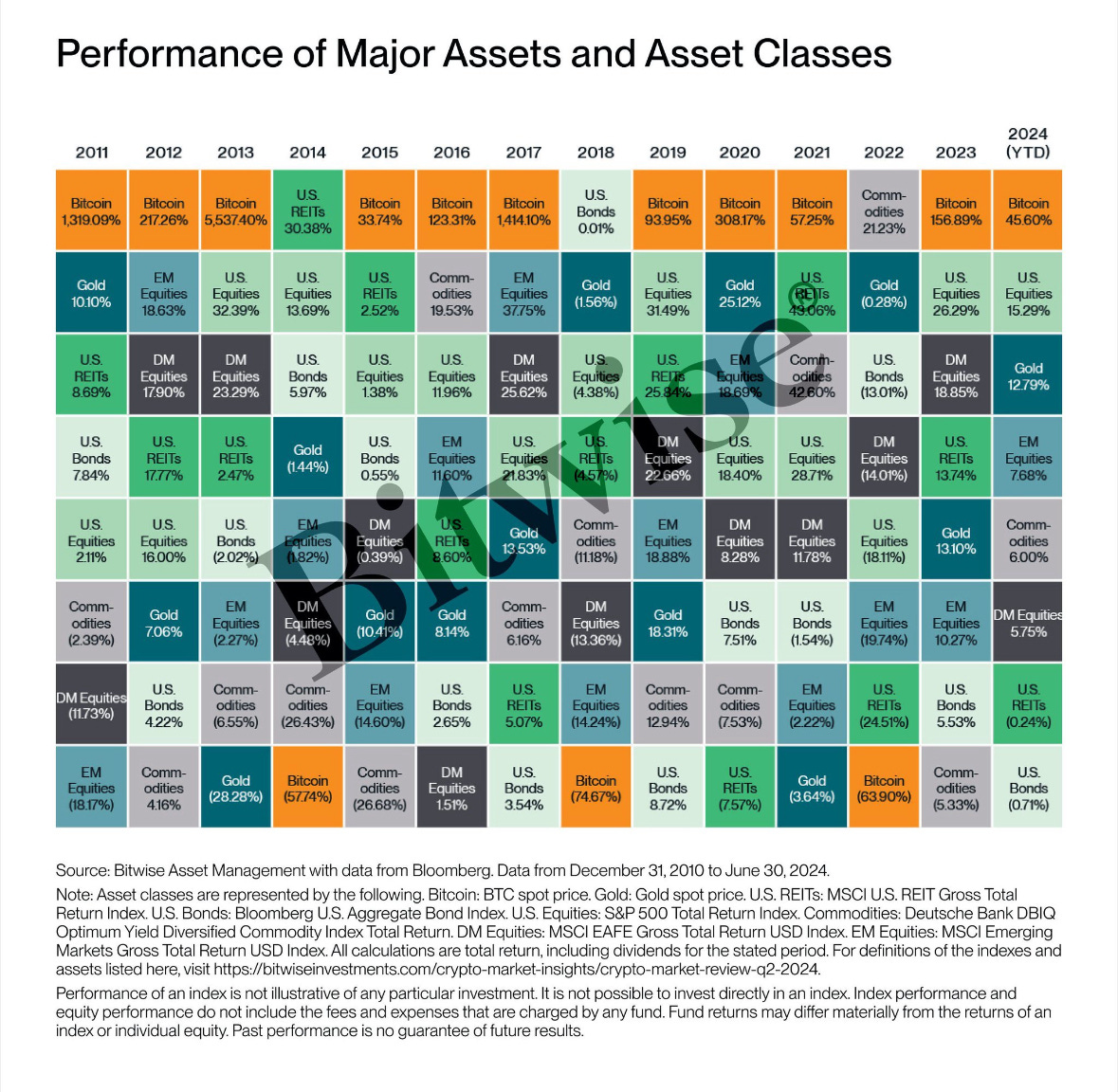

Despite its notorious volatility, Bitcoin has consistently outperformed traditional asset classes over the past decade. While stocks and bonds can yield low double-digit annual returns, Bitcoin has seen triple-digit percentage gains in multiple years, though it has also experienced significant drawdowns. This extreme performance, both positive and negative, reflects Bitcoin's nature as a nascent, high-risk asset that has attracted significant speculative interest alongside growing institutional adoption.

The Finance Hub is a reader-supported publication. To gain access to premium content and live webinar replays, consider becoming a paid subscriber

Now, back to our regular scheduled topic:

The global economy runs on a debt-based system. This means that every currency unit is a liability to someone else. For example, the currency notes in your wallet are a liability of your central bank and the numbers on your bank account are a liability of the bank. Before 1971, we used to run on a “Gold backed” system where all currency in circulation was backed by a certain weight of gold. This put a restraint on the government’s ability to create money by forcing them to get the gold required for every new unit of currency created. After we came off of the Gold Standard in 1971, we moved to the current debt-based system which creates money by bank or government lending (loans and bonds respectively). When banks issue loans or governments issue bonds, they effectively create new money, increasing the overall supply. From our last Finance Hub Live event, Dollars and Sense, we understand that this should effectively lead to inflation right? But not so fast, our governments have been able to shield us from the impacts of an increasing money supply until recently…

Over the past several decades, developed economies have managed inflation by outsourcing production to countries with cheaper labor costs, particularly in Asia, where wages were lower. This trend, which accelerated in the 1970s and 1980s (after we came off the gold standard), was enabled by advances in transportation, technology, and trade agreements that reduced tariffs. Outsourcing allowed developed nations to import goods at lower costs, particularly in sectors like electronics and clothing, which helped control inflation by mitigating the rising domestic production costs that would have pushed prices higher.

The outsourcing of production to developing countries has profoundly impacted developed economies like the United States and the United Kingdom. While consumers benefited from cheaper goods, this shift led to significant economic and social consequences. Millions of manufacturing jobs in developed economies were lost, with middle-income, often unionized jobs with benefits being replaced by lower-wage service sector positions or resulting in long-term unemployment. This transition contributed to income stagnation and widening inequality, weakening the middle class and creating a larger gap between the wealthy and the working class. Large corporations and their shareholders emerged as the primary beneficiaries of this outsourcing trend.

The ripple effects of these changes extended to government finances and policies. Job losses led to a lower taxable base, forcing governments in developed nations to increase debt levels. They often relied on low interest rates to finance public services and stimulus programs, aiming to support economically displaced individuals while maintaining demand for cheap imports. This approach, however, has created its own set of challenges and vulnerabilities.

The economic model of outsourcing and borrowing is now facing new pressures. Wages are rising in traditionally low-cost countries like China and India, eroding some of the cost advantages that initially drove outsourcing. Additionally, recent global events have exposed the fragility of extended supply chains, as seen during the COVID-19 pandemic. Escalating global tensions, such as the Russia-Ukraine conflict and crises in the Middle East, have further complicated the international economic landscape.

In response to these challenges, developed economies now face pressure to invest heavily in rebuilding their manufacturing bases. This push aims to counter rising inflation and ensure economic resilience in an increasingly uncertain global environment. However, these nations face significant obstacles in this endeavor, primarily in the form of soaring debt levels and higher interest rates. The United States, for instance, saw its national debt surpass $35 trillion by 2024, limiting its fiscal flexibility.

Much of the increase in spending is attributed to large-scale stimulus packages implemented in response to the COVID-19 pandemic, as well as ongoing spending on social security, healthcare, and defense. Additionally, the 2017 Tax Cuts and Jobs Act reduced corporate tax rates, which significantly lowered government revenue, further widening the deficit (when government spending is higher than the taxes collected). Rising interest rates have also added to the cost of servicing the national debt, as interest payments now constitute a growing portion of the federal budget.

On the flip side, while there is an incentive to bring manufacturing locally to improve the resilience of developed economies and reverse the trend over the last few decades, we see a trend developing in white-collar jobs. Similar to how blue-collar manufacturing jobs we shipped overseas for lower labor costs, we are seeing the same thing with white-collar jobs. Many corporations and businesses are building “Technology” or “Solution” centers in India, Malaysia, or the Philippines to replace jobs that could be performed remotely. These include bookkeeping, paralegal, or design engineering roles. The transition of these jobs overseas has led to lower overhead costs for businesses and a reduction of their local workforce. Granted, white-collar jobs make up a smaller percentage of the overall workforce, but they also make higher incomes and this could have a net negative impact on government revenues.

As these trends continue, the U.S. fiscal deficit is projected to grow, creating long-term sustainability concerns for the national economy because of the need to support these newly displaced workers. From figure 1 above, the US government has not been able to collect enough taxes to satisfy its obligations since 2001 and the deficit keeps growing. And you know how the US government makes up the difference between the taxes collected and all the money they spend? More debt and money printing, leading to the debasement of the currency. With this in mind, when we see prices of goods going up, it is not because they are going up in value, but because the value of the currency is depreciating relative to these goods. This inflation trend is going to continue unless the government decides to drastically increase taxes to cover all current obligations or cut a lot of spending on social support programs or defense. These are politically unfeasible, so we expect currency debasement to continue.

Now what does this mean for us? Sustained higher inflation erodes the purchasing power of regular working people, making it more difficult for us to afford everyday essentials like food, housing, and transportation. As prices rise, wages often fail to keep pace with inflation, leaving workers struggling to maintain their standard of living. This is particularly challenging for low- and middle-income households, who spend a larger proportion of their income on necessities. Higher inflation also increases the cost of borrowing, making loans for homes, cars, and education more expensive, while savings lose value over time. For those without assets that appreciate with inflation, such as real estate, equity investments (stocks), or Bitcoin, the impact is even more severe, exacerbating economic inequality and financial insecurity.

That is why investing is essential to preserve and grow purchasing power, especially in an environment of sustained inflation. When inflation rises, the value of cash savings diminishes over time, as the same amount of money buys fewer goods and services. By investing in assets that have the potential to outpace inflation, such as stocks, Bitcoin, real estate, or inflation-protected securities, individuals can generate returns that help maintain or increase their wealth. Investments typically offer higher returns than traditional savings accounts, which rarely keep up with inflation rates. Without investing, we risk losing purchasing power, making it harder to achieve financial goals like retirement, buying a home, or funding education. Investing not only protects against inflation but also creates opportunities for wealth accumulation over the long term.