Hey guys, I hope you had a 4th of July weekend filled with friends, family, food and fireworks! Last week, the US Congress approved through both chambers of Congress H.R. 1, aka the One Big Beautiful Bill Act (OBBB/OBBBA). But depending on who you ask, it’s either a bold reboot of American prosperity or a fiscal time bomb wrapped in shiny tax breaks while stripping benefits from the vulnerable population. Passed in a nail-biting vote just before the July 4th holiday, this sweeping legislation touches everything from your paycheck, child tax credit and health benefits to the strength of the U.S. dollar abroad. As a small business owner, a parent, an investor, or someone just trying to make sense of where the economy is headed, this bill is about to impact your money in ways you can’t ignore. In this article, we will review what’s really inside, and what it means for your future.

Before we dive into the topic of the day, I’ll share a cool and random economic fact of the week. Let’s call these RBI’s (Random But Interesting). These facts will give us useful info, often with a picture or chart to make it clearer. The aim is to help us make smarter financial choices

Random But Interesting (RBI)

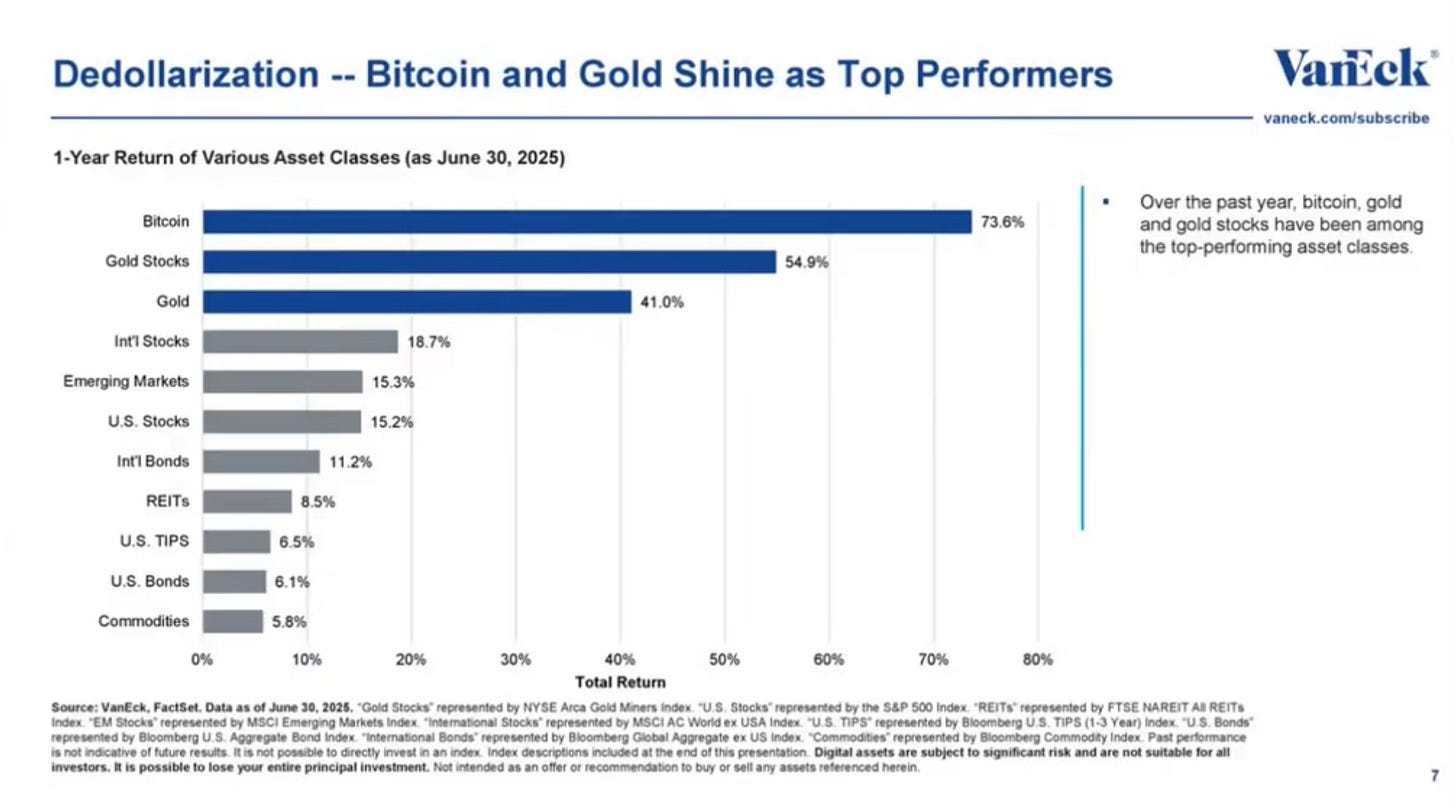

Over the past 12 months, Bitcoin and gold have significantly outperformed traditional asset classes, reinforcing their appeal as alternative stores of value in a high-deficit, inflation-wary environment. Bitcoin has provided 74% returns over the last 12 months ending June 30th, driven by growing institutional adoption, ETF approvals, and a flight from fiat amid weakening dollar sentiment. Gold also climbed nearly 55%, reaching new all-time highs as central banks globally ramped up their bullion purchases and investors sought safety from geopolitical instability and ballooning U.S. debt. In contrast, stocks delivered more modest gains, while bonds continued to face pressure from rising yields and fiscal uncertainty. This highlights the shifting investor preference toward scarce, non-sovereign assets.

The Finance Hub is a reader-supported publication. To gain access to premium content and live webinar replays, consider becoming a paid subscriber

Now, back to our regular scheduled topic:

So now that the bill is signed into law, what’s really in it? Some major changes include:

Permanence for the 2017 Trump-era tax cuts.

New tax breaks: no taxes on tips/overtime, raised State and Local Tax (SALT) deduction cap ($40K), extra $6,000 deduction for older workers.

Expanded Child Tax Credit ($2,200 through 2028; $2,000 thereafter) and proposed “MAGA savings accounts”($1,000 per child).

Defense +$150 billion; border security enhancements (~$70 billion).

Work requirements for Medicaid/SNAP, meaning rollbacks in welfare spending.

Phasing out of clean‑energy tax credits under the Inflation Reduction Act.

Expanded debt limit by $4 trillion.

Estimates of adding $2.4–2.8 trillion to deficits by 2034 over current law (en.wikipedia.org, whitehouse.gov, piie.com).

The Senate passed its version 51–50 (tie‑breaker by VP Vance), which mirrored the House’s changes. On July 3, the House ratified the Senate changes by a narrow 218–214 vote, and the bill signed by the president on July 4th.

📌 Who Gains? Who Loses?

🎉 Victors

Middle‑income households gain certainty. By locking in the 2017 tax cuts, paired with SALT, tip/overtime relief, and the expanded Child Tax Credit, many working families could see their take‑home pay rise significantly.

Older Americans (under $75K income) get a one-time $6,000 deduction.

Small business owners benefit from 100% bonus depreciation and an increase in the Small Business Deduction from 20% to 23% (livemint.com, whitehouse.gov).

Defense and home‑grown energy sectors see boosts: +$150 billion to defense (drones, missile defense, border, etc.) and rollback of renewables support in favor of fossil/nuclear‑backed reliability (en.wikipedia.org).

😥 Losers

Low‑income families and Medicaid/SNAP recipients bear the brunt of cuts via stricter work/eligibility rules. The Congressional Budget Office (CBO) estimates as many as 10.9–11.8 million people could lose coverage (whitehouse.gov).

Clean‑energy industry, especially in places like Texas, faces a $87 billion GDP hit & ~120,000 job losses through 2035 (expressnews.com).

High earners in high-tax states. Though capped at $40K, it still benefits wealthier filers more than middle‑class taxpayers .

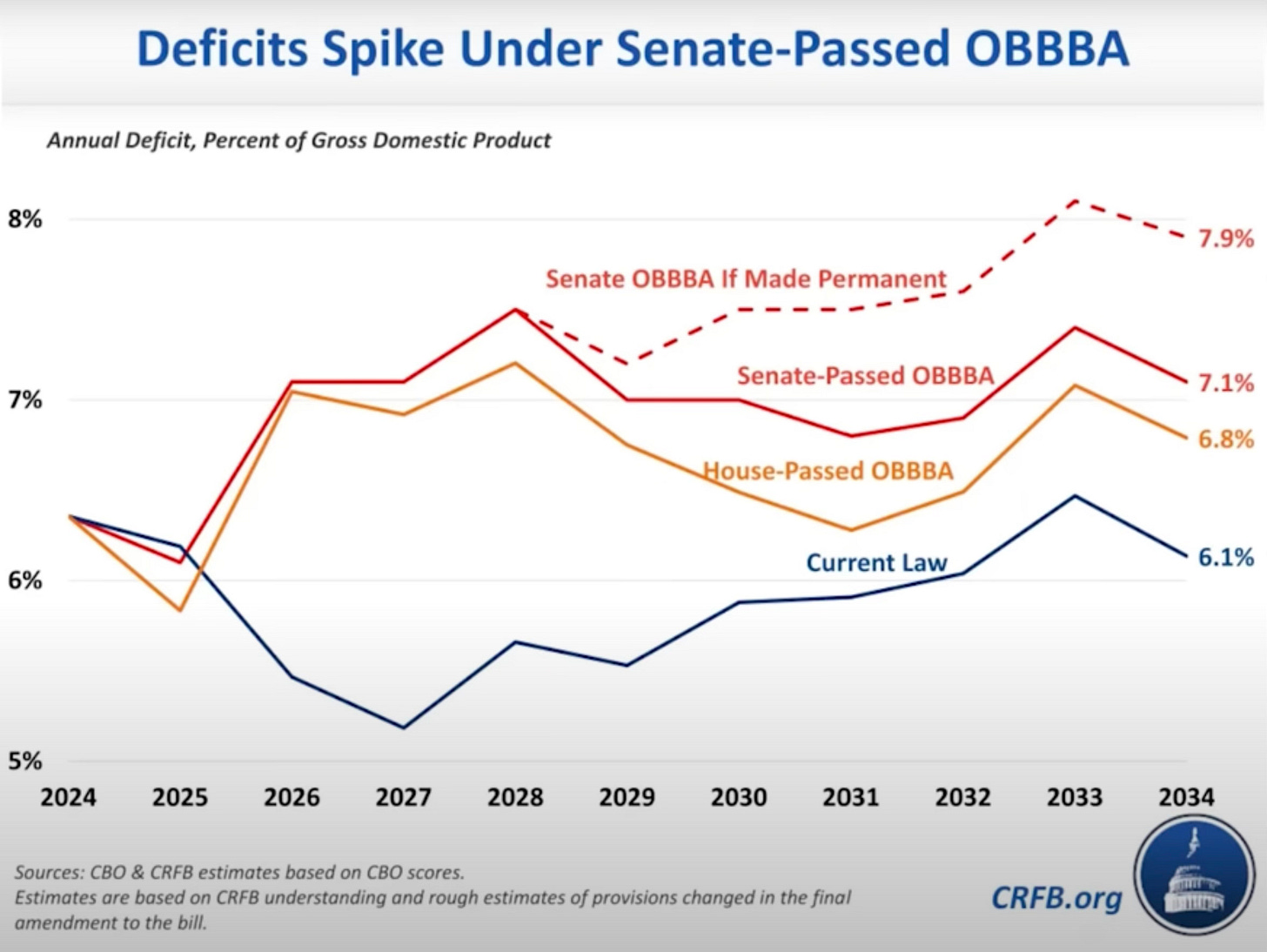

The Congressional Budget Office (CBO) estimates that the Big Beautiful Bill will add approximately $2.4 trillion to the national debt by 2034, a figure that has recently been revised upward to $2.8 trillion. Publications such as Time Magazine have flagged deeper structural risks, warning that U.S. debt could balloon to nearly $40 trillion, or about 130% of GDP, over the next decade. This path could force the government to either raise taxes, slash spending, or resort to inflationary tactics like monetary easing to manage the burden. A major concern is the bill’s fiscal timing: it front-loads tax cuts while gradually phasing in welfare reductions. If future lawmakers choose to extend these tax breaks without offsets, the deficit outlook could deteriorate even more rapidly. Complicating matters further, the legislation only raises the debt ceiling by $4–5 trillion, far short of the roughly $24 trillion in liabilities coming up in future years. This is setting the stage for another round of fiscal gridlock or default threats like we had with this one. These concerns are already impacting financial markets: Moody’s has downgraded U.S. debt, citing poor transparency and questionable accounting practices, while Treasury auctions (attempts by the government to raise money through selling debt) are showing signs of investor fatigue, as growing deficits stoke skepticism and upward pressure on bond yields.

Financial markets are reacting with optimism in the short term, as the White House projects GDP growth of 4.6% to 4.9%, fueled by increased consumer spending and business investment following the passage of the Big Beautiful Bill. Defense and energy stocks are expected to benefit from new government spending and purchases from foreign countries looking to take control of their defense, while clean-energy stocks may struggle due to the rollback of renewable tax credits (This could hurt ESG-aligned portfolios). On the fixed income side, bond yields could continue rising, with a steeper yield curve reflecting heightened concerns over mounting deficits and inflation risks. At the same time, foreign appetite for U.S. Treasuries is weakening, contributing to a roughly 11% decline in the U.S. dollar over the past six months, the sharpest drop since 1973.

The widening fiscal and current account deficits are compounding pressure on the dollar, with some analysts predicting an additional 30–35% depreciation may be necessary to restore balance. This trend has triggered concerns about America’s reserve currency status, as declining foreign demand for Treasuries could drive yields higher and reduce global confidence in the dollar. If this erosion continues, U.S. monetary policy may be forced into a difficult choice: stimulate growth or defend the dollar.

👥 Impacts on Regular Americans

The Big Beautiful Bill brings immediate boosts to take-home pay for many Americans through extended tax cuts, expanded credits, and new exemptions on overtime and tip income. This is especially meaningful relief for working-class families. Parents stand to gain from an increased Child Tax Credit and the introduction of new child-focused savings accounts designed to encourage long-term financial planning. However, not all households benefit equally. Changes to Medicaid and SNAP include stricter work requirements and tighter eligibility rules, which could result in as many as 11 million able-bodied adults without children losing access to these critical safety nets. For many low-income families, this shift could mean a rise in medical debt and greater financial instability.

At the same time, the bill’s rollback of renewable energy credits and pivot toward fossil fuels and nuclear energy may lead to higher utility in areas that rely heavily on renewable energy. In Texas, projections show a possible $780 annual increase in energy costs per household and an additional as the state works to shift to cheaper energy sources. A weakening U.S. dollar further complicates the picture, with imported goods becoming more expensive, potentially fueling consumer inflation if domestic production doesn’t ramp up to offset the depreciation.

Politically, the bill scraped through Congress by the thinnest margins (218–214 in the House and 51–50 in the Senate), highlighting stark divisions within the GOP and between the parties. Critics such as Senator Ron Johnson have slammed the legislation’s budget math as unsustainable, warning that it could drive an additional $24 trillion in debt over the next decade. Even public figures like Elon Musk have voiced opposition to the bill’s spending structure, prompting retaliation threats from Trump regarding Musk-linked federal contracts. Beyond the political drama, bipartisan economists and rating agencies are raising red flags about the bill’s accounting tactics, accusing lawmakers of masking permanent tax cuts as temporary. Creating fiscal illusions that may erode long-term economic credibility.

The table below provides a summary of the potential impact of this new legislation over various time periods:

The One Big Beautiful Bill is a dramatic gamble, prioritizing immediate tax relief and defense spending at the expense of long-term fiscal integrity and social safety nets. Its ultimate legacy may hinge on whether future Congresses choose to sustain tax relief or rein in ballooning deficits.

Very good overview of the bill in a very concise article length! Many thx for sharing, as I had wanted to know the details in few words. It’s a double-edged sword, which I hope eventually works for the good of many more than currently anticipated by its look. So the next practical thing is to know how stakeholders on this platform can position themselves to maximize benefiting from it - small business owners, employer, employees, parents. Maybe a discussion.